Reading time: 8 min

I’m 32 years old, debt-free, and I plan to die debt-free. Meanwhile, most people my age are already slaves to banks, car dealers, landlords, and their own stupidity. Loans, mortgages, credit cards, “buy now, pay later” scams… people happily sign their lives (and kidneys) away just to look like they’re “living.” Spoiler: they’re not living — they’re paying.

I didn’t get here because I’m rich. I didn’t get here because I stumbled into some magical crypto pump. I got here because I refuse to do dumb financial shit. I live with rules. Real rules. Rules anyone could follow — but won’t, because chasing shiny crap is easier than using common sense.

So here it is: my no-BS, sarcastic, 20-rule guide to staying free while everyone else chains themselves up.

1. Don’t Buy What You Can’t Afford

If you don’t have the money, don’t buy it. Revolutionary, right? Yet somehow, society treats financing garbage like it’s oxygen. Cars, phones, sneakers, couches — people will literally drown themselves in debt just to flex.

Me? If I can’t pay for it in full and handle its upkeep without sweating, it’s a no. End of story.

2. Credit Is a Tool, Not Free Money

I’ve got a credit card. Here’s how I use it: I run my expenses through it, rack up points, cashback, and perks — then I nuke the balance the second my salary hits. Result? Free coffee, free gas, free flights.

Banks hate me. Good. I don’t pay them a cent of interest. I get their rewards while everyone else drowns in minimum payments.

3. Cars Are Tools, Not Status

Your car isn’t your personality. It’s a machine. But people finance luxury SUVs and sports cars like it’ll magically give them character. Then they cry when the check engine light comes on and the repair costs more than their rent.

My rule: cars are tools. If I can’t buy it outright, if I can’t maintain it comfortably, I don’t touch it. Flexing isn’t worth financial chains.

4. Housing + Bills = 30% Max

Rent = 15% of my salary. Bills = another 15%. That’s 30% total. The rest is mine — to save, invest, or enjoy.

Meanwhile, half the world is dropping 40–50% of their income just to keep the lights on, then crying about being broke. If your house is choking you, it’s not a home — it’s a prison.

5. Invest in Sweat Equity (Build, Don’t Just Buy)

Forget chasing meme stocks or gambling on crypto coins because some dude on YouTube told you to “ape in.” The best investment you can make is in something you can actually build or control. That’s sweat equity — putting your time, skills, and effort into creating value, not just throwing cash at a slot machine and hoping it prints.

Examples?

Good at coding? Build a small SaaS tool or an app that solves a niche problem. Even if it only makes a few hundred bucks a month, that’s real, repeatable value.

Have a trade skill? Start freelancing or build a side hustle. Web design, carpentry, landscaping, photography — anything you can own instead of “work for.”

Got ideas but no money? Partner with someone who needs your skills. Your sweat + their cash = ownership stake.

Sweat equity is the quiet millionaire-maker. The restaurant owner who started washing dishes. The mechanic who opened his own shop. The guy who built a side hustle that turned into a business.

Invest in things you can touch and grow. Buy shares in yourself before you gamble on some stranger’s dream.

6. Want vs Need

Impulse shopping is self-sabotage with a receipt. Before I buy, I ask: do I want this, or do I need this?

Most of the time, the answer saves me money. And when I do splurge, it’s because I decided to — not because an ad hypnotized me into it.

7. DIY Everything You Can

Why pay someone $200 when I can fix it with a $20 tool and YouTube? I buy tools, I learn skills, and I solve problems myself.

That’s one-time money for lifetime savings. Plus, I don’t have to wait for some technician who shows up late and charges me to press one button.

8. Cook More, Eat Out Less

Eating out every day is financial suicide. That “small” lunch habit adds up to thousands a year.

I cook most of the time. When I eat out, it feels like a treat instead of just another line item bleeding my wallet dry.

9. Hack Experiences

Why pay $15 for a café latte by the beach when I can roll my Jimny to the shore, set up hookah, coffee, and snacks, and have a better time for basically free?

Stop buying “ambience.” Make your own. The vibe is real, the bill is not.

10. Kill the Logo Tax

Logos are financial cancer. Ray-Bans? $5 plastic rebranded as $100 “heritage eyewear.” Amazon “Made in Italy” backpacks? Same Chinese bag Temu sells for 1/15th the price.

I buy function, not ego. Status logos don’t make you rich — they make you broke with style.

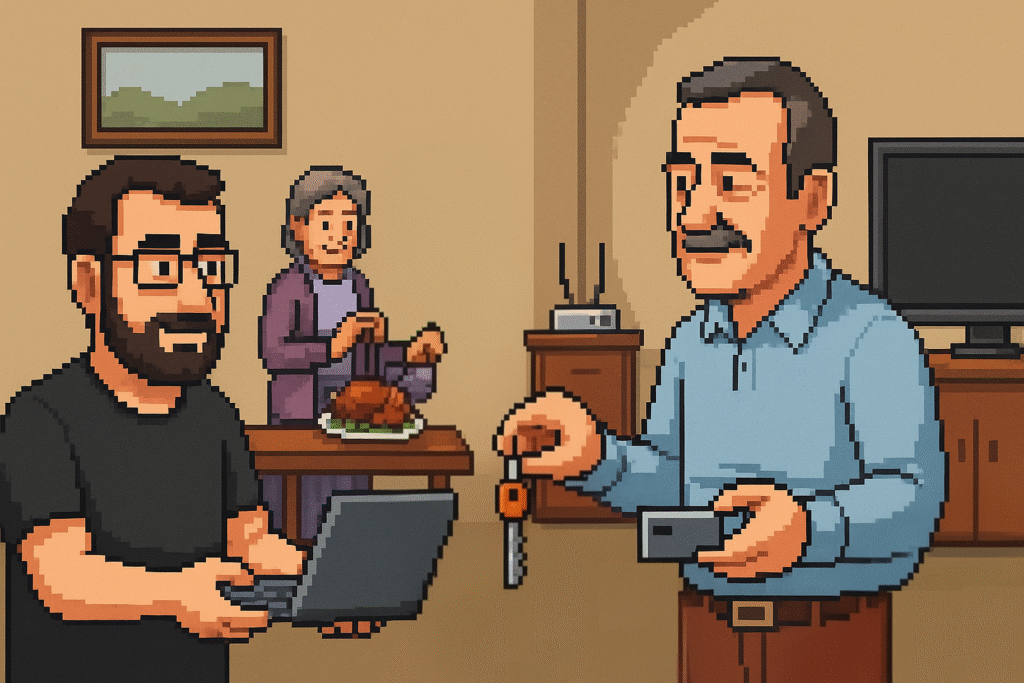

11. Family Help = Fair Trade

Family help isn’t weakness — unless you mooch. My dad bought me a car; I run IT for his factory. My uncle and aunt spoil us with outings; I fix their tech.

It’s trade. Value for value. No guilt, no freeloading, no awkwardness. That’s how you do it.

12. Friends = Value Exchange

Same rule for friends. My accountant buddy does my taxes. I fix his IT. We babysit for each other, we swap food, gifts, and favors.

That’s friendship: everyone brings something. Or you could pay strangers for all that and cry about expenses. Up to you.

13. Loyalty & Timing = Freebies

Already spending money? Milk it. Shell app = free gas and coffee. Credit cards = cashback. Hotel loyalty = perks and discounts.

Add timing, and you win big. Dubai hotels in winter cost triple. Go off-season, deal with slightly worse weather, save thousands. Smart > trendy.

14. Read the Fine Print

People don’t go broke from what they buy. They go broke from what they sign.

Credit cards. Loans. Mortgages. The devil lives in the fine print. I don’t sign squat until I’ve read every line. If I don’t get it, I walk. Eager signatures are financial suicide.

15. Don’t Gamble (and Watch the Booze)

The lottery? You’ve got a better shot at finding a bag of cash under your bed. Gambling is a guaranteed loss dressed up as “hope.”

And drinking as a habit? It bleeds you dry. A beer here, a bottle there, a night out every weekend — it all adds up. If you’re gonna burn money, at least set it on fire yourself so you can enjoy the glow.

16. Ignore Social Media Flex Traps

TikTok dancers. Instagram wannabes showing off a “new car” every week. Most of it’s rented, leased, or straight-up fake.

It’s a trap. You see it, you compare, you feel poor — and then you go broke trying to imitate someone who’s already broke behind the scenes.

Social media is entertainment, not a financial blueprint. Treat it that way, or get fleeced.

17. Buy Function Over Status (Everything)

Phones. Cars. Clothes. Laptops. Watches. Appliances. Stop buying for logos, start buying for function.

iPhones? Same damn phone for 10 years with a new camera slapped on. If you need social media, get a phone with a good screen and battery. If you’re an adventurer, get something rugged. If you just call and text, a midrange does the job.

Same rule applies everywhere. Buy for your life, not for the flex. And buy things that last. Replacing less often = saving more often.

18. Stop Overcompensating — Gratitude Beats Comparison

Comparison is the thief of joy. You’ll always find someone with a shinier car, a bigger house, or a pricier suit. Chase that, and you’ll be broke forever.

Be grateful for what you have. Enjoy your own wins. Because the people you’re comparing yourself to? Half of them are drowning in debt behind the curtain. Don’t compete with misery.

19. Cancel Subscription Creep

You know what’s eating your wallet while you’re not looking? Subscriptions. Netflix, Disney+, Spotify, the gym you don’t go to, some random app you signed up for in 2019. Ten bucks here, fifteen there — death by a thousand cuts.

Audit your subscriptions. Keep what you actually use. Cancel the rest. Subscriptions are leeches disguised as convenience.

20. Build an Emergency Fund (Your Safety Net)

Debt-free doesn’t just mean “no loans.” It means being prepared so you don’t need loans when life kicks you. Job loss, car breakdown, medical bills — without a cushion, you’ll run straight to debt like everyone else.

An emergency fund is boring. It’s not Instagram-worthy. But it’s the difference between “calm problem-solving” and “oh shit, I’m broke.” Even a few months of expenses tucked away buys you sanity.

The Bottom Line

Being debt-free isn’t glamorous. It’s not sexy. It’s not a TikTok hack. But it’s freedom.

I rent cheap. I drive what I can afford. I DIY. I swap skills with family and friends. I milk loyalty programs. I don’t gamble. I don’t drown in booze. I don’t worship logos. I cancel subscriptions that bleed me. I keep a cushion for when life punches me.

Thirty-two years, zero debt. And I’ll say it bluntly: freedom tastes better than overpriced coffee, leased SUVs, rented Instagram flexes, and whatever the hell Apple tries to sell you next year.

You can keep your debt. I’ll keep my freedom.

Hey! Wanna see other random topics and rants? Check this out: Random blogs